The food industry in India has witnessed tremendous growth in recent years, with bakeries becoming one of the most popular small and medium-sized businesses. From freshly baked bread and cakes to cookies and pastries, millions of people consume bakery products daily. However, ensuring food safety and maintaining hygiene is equally important in this sector.

To protect consumers and regulate the food industry, the Food Safety and Standards Authority of India (FSSAI) mandates that every bakery business must obtain a valid FSSAI license. For bakery owners, having an FSSAI license for bakery shop is not just a legal requirement but also a mark of trust that assures customers about the safety and quality of the food being served.

Table of Contents

--------------Blog Contact Form-------------

What is FSSAI License?

The FSSAI license is a certification issued by the Food Safety and Standards Authority of India under the Ministry of Health and Family Welfare. It ensures that all food business operators (FBOs) in India comply with the Food Safety and Standards Act, 2006. The license acts as proof that the bakery or any other food business is following proper hygiene, safety standards, and quality control measures while producing and selling food items.

Every food business operator, whether running a small bakery, large manufacturing unit, or packaged food company, must obtain either FSSAI registration or an FSSAI license depending on the size and nature of operations. For bakery shops, it becomes crucial since bakery items usually have a shorter shelf life and need to be replaced frequently, making safety checks even more important.

Importance of FSSAI License for Bakery Shop

Having a valid bakery license in India is important for several reasons:

- Legal Compliance: Running a bakery without an FSSAI food license can attract penalties and even closure of business.

- Consumer Trust: Customers today look for the FSSAI logo on food packaging as proof of safety and quality.

- Business Expansion: The license helps in expanding to new markets, opening branches, or selling through online platforms like Zomato, Swiggy, and e-commerce websites.

- Brand Value: A licensed bakery stands out in the competitive market and builds a positive reputation.

- Food Safety Assurance: Ensures that the food sold is safe, hygienic, and free from health hazards.

Types of FSSAI License for Bakery Business

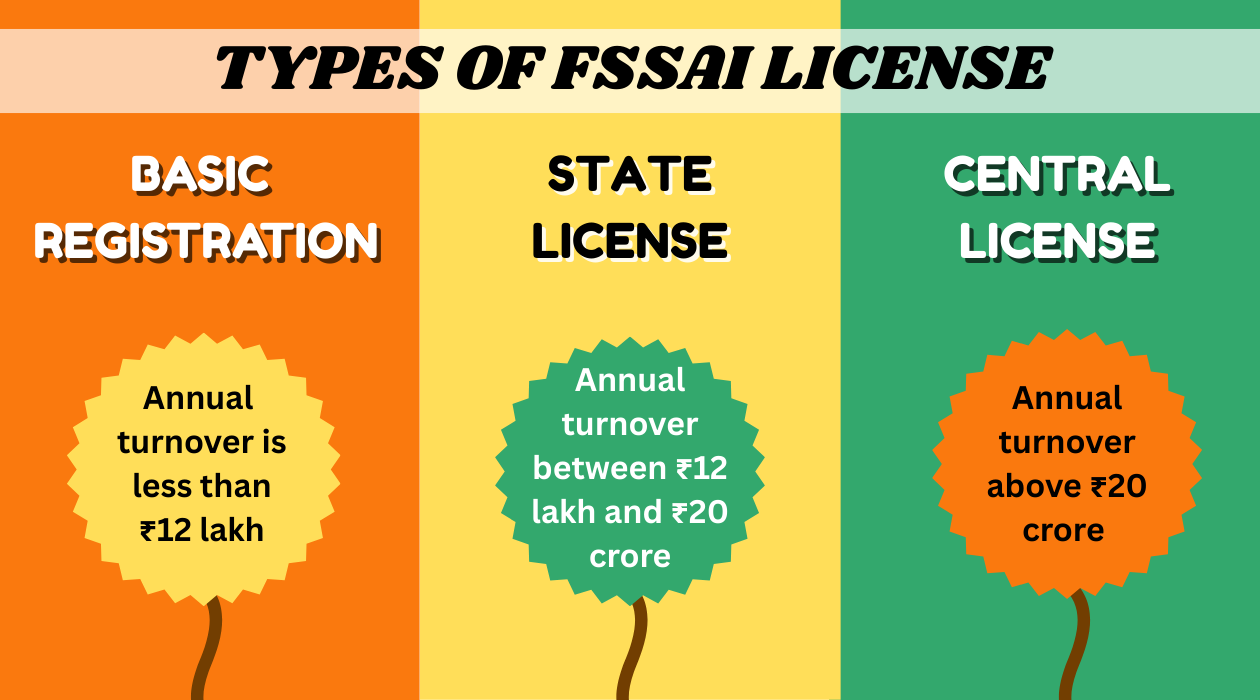

The type of food license for bakery shop depends on the scale of operations, turnover, and business size. There are three main categories:

1. FSSAI Basic Registration

- For small bakery businesses with an annual turnover of less than ₹12 lakh.

- Suitable for home bakers or small outlets.

2. FSSAI State License

- Required for medium-sized bakeries with turnover between ₹12 lakh and ₹20 crore.

- Issued by the State Government.

3. FSSAI Central License

- Mandatory for large bakeries with turnover above ₹20 crore.

- Also required if the bakery is operating in multiple states.

Process of Getting FSSAI License for Bakery Shop

The process of obtaining a bakery business license in India involves multiple steps. A bakery owner needs to follow the procedure carefully to avoid delays:

1. Form Filling

The bakery owner or FBO must fill out the online application form available on the FSSAI registration portal. It is advisable to download the form first to understand the required details before submitting it.

2. Documents Submission

After completing the form, relevant documents such as identity proof, address proof, business incorporation details, and food product list are submitted online.

3. Application Review

The application and documents are forwarded to the local FSSAI office for inspection. Officials check the type of bakery items produced and conduct safety checks.

4. Inspection and Verification

An FSSAI officer inspects the bakery premises to ensure hygiene and food safety standards are being followed.

5. License Approval

Based on the inspection report, the license is approved. Generally, it takes 10-30 working days for the bakery to receive its FSSAI food license certificate.

6. Payment of Fees

The FBO has to pay the prescribed FSSAI registration fees, which vary depending on the business size and license category. Payments can be made online through the FSSAI portal.

7. FSSAI Registration Certificate

Once the process is completed, the bakery shop gets its official FSSAI registration certificate, which is valid for a specific period and can be renewed before expiry.

Benefits of FSSAI License for Bakery Owners

Obtaining an FSSAI license for bakery shop provides multiple advantages:

- Builds trust with customers.

- Helps in selling bakery products online and offline.

- Provides a competitive edge in the food business market.

- Mandatory for exporting bakery products abroad.

- Protects business owners from heavy fines and legal issues.

Conclusion

The bakery industry in India is booming, but success in this sector depends on both quality and compliance. Obtaining an FSSAI license for bakery shop is not just a legal necessity but also a business growth tool. It ensures that the bakery follows proper hygiene, meets safety standards, and earns customer trust.

Whether you are a small home baker or running a large bakery chain, securing the right type of FSSAI registration for bakery is the first step toward building a reliable and sustainable business. By following the process and adhering to food safety norms, bakery owners can expand confidently while ensuring the health and safety of their customers.

This portion of the site is for informational purposes only. The content is not legal advice. The statements and opinions are the expression of author, not corpseed, and have not been evaluated by corpseed for accuracy, completeness, or changes in the law.

BOOK A FREE CONSULTATION

Get help from an experienced legal adviser. Schedule your consultation at a time that works for you and it's absolutely FREE.