How to Generate E-Way Bill

An e-Way bill is an electronically generated document that is required for the transportation of goods worth more than INR 50,000 within India. It is a part of the Indian government's Goods and Services Tax (GST) system and is used to track the movement of goods from one place to another. The e-Way bill contains information about the consignor, consignee, and the goods being transported, along with other relevant details. It is mandatory for all taxpayers to generate an e-Way bill for each consignment of goods transported, and failure to do so can result in penalties and fines.

Table of Contents

It's important to note that it's also possible to generate e-way bill through APIs or by using software solutions provided by various vendors.

The supplier or transporter can create an e-Way bill through the following ways:

- Online: By accessing the official e-Way bill portal of the Indian government and following the steps to generate a new e-Way bill.

- SMS: By sending an SMS to the designated number with the required information to generate the e-Way bill.

- Android App: By downloading the e-Way bill Android application and generating the e-Way bill through the app.

- API (Application Programming Interface): By integrating the e-Way bill API into their own systems and generating the e-Way bill through the API.

Regardless of the method used to generate the e-Way bill, it must contain accurate and up-to-date information about the consignor, consignee, and the goods being transported.

Read Our Blog: E-Way Bill: One Tax One Market Systems, Rules and Generate Process

Who need E-Way bill?

E-Way Bill applies to all registered and unregistered persons who are involved in the transportation of goods, including manufacturers, suppliers, transporters, and recipients of goods.

It is mandatory to have an e-way bill if the goods are being transported by road, rail, air, or ship. It is not required for the movement of goods within the same state, but it is mandatory for the inter-state movement of goods.

Also, in some cases, even if the value of goods is less than INR 50,000, e-way bill is required if the goods fall under specific category like Handicraft goods, Agricultural produce, etc.

It's important to note that e-way bill is not required for some specific category of goods and/or in some specific cases as specified by the government from time to time. It's always recommended to check the latest rules and regulations before generating e-way bill.

| Latest Updates on E-way Bills |

|

29th August 2021 Taxpayers will not be forced to blocking of e-way bills from May 1 through August 18, 2021, for filing to file GSTR-1 or GSTR-3B (two months or more for monthly filers and one quarter or more for QRMP taxpayers) during the period of March 2021 to May 2021. August 4, 2021 Blocking of e-way bills because GSTR-3B has not been filed will begin again on August 15, 2021. 1st June 2021

18th May 2021 The blocking of GSTINs for the generation of e-Way Bills is now only taken into consideration for the GSTIN of the defaulting supplier and not for the GSTIN of the defaulting recipient or the transporter, according to the CBIC's Notification 15/2021-Central Tax. |

When Should you Generate the Bill?

The E-way bill should be generated before the movement of goods begins. The consignor or the supplier of the goods is responsible for generating the E-way bill, and it should be generated at least one hour before the goods are moved.

In the case of the transportation of goods by road, the E-way bill should be generated before the goods are loaded onto the vehicle. In the case of rail, air, and ship transportation, the E-way bill should be generated before the goods are handed over to the carrier.

It's important to note that the E-way bill is valid for only one day for a distance of less than 100 km and for 1 to 15 days for longer distances. Depending on the distance of transportation and the validity of e-way bill, the bill should be generated accordingly.

In case of any discrepancy in the details provided in the E-way bill and the actual movement of goods, then the transporter will be liable for penalties as per the GST laws.

Prerequisites for e-Way Bill Generation

The prerequisites for generating an e-Way bill are as follows:

- GSTIN: A valid GST Identification Number (GSTIN) of the consignor or consignee.

- Invoice or Bill of Supply: A valid invoice or bill of supply for the goods being transported, containing the details of the consignor, consignee, and the goods being transported.

- Transporter ID: If the goods are being transported by a transporter, the transporter ID must be provided.

- Vehicle Number: The vehicle number or the LR/GR number must be provided for the mode of transportation.

- Place of Dispatch and Place of Receipt: The place of dispatch and place of receipt must be provided, along with the pin codes.

- Type of Goods: The type of goods being transported must be specified, along with the HSN code and quantity.

- Value of Goods: The value of goods being transported must be provided.

All of this information is mandatory to generate an e-Way bill and must be accurate and up-to-date. The e-Way bill can be generated through the official e-Way bill portal of the Indian government or through an authorized GST Suvidha Provider (GSP).

Steps to Generate E-Way Bill through Website

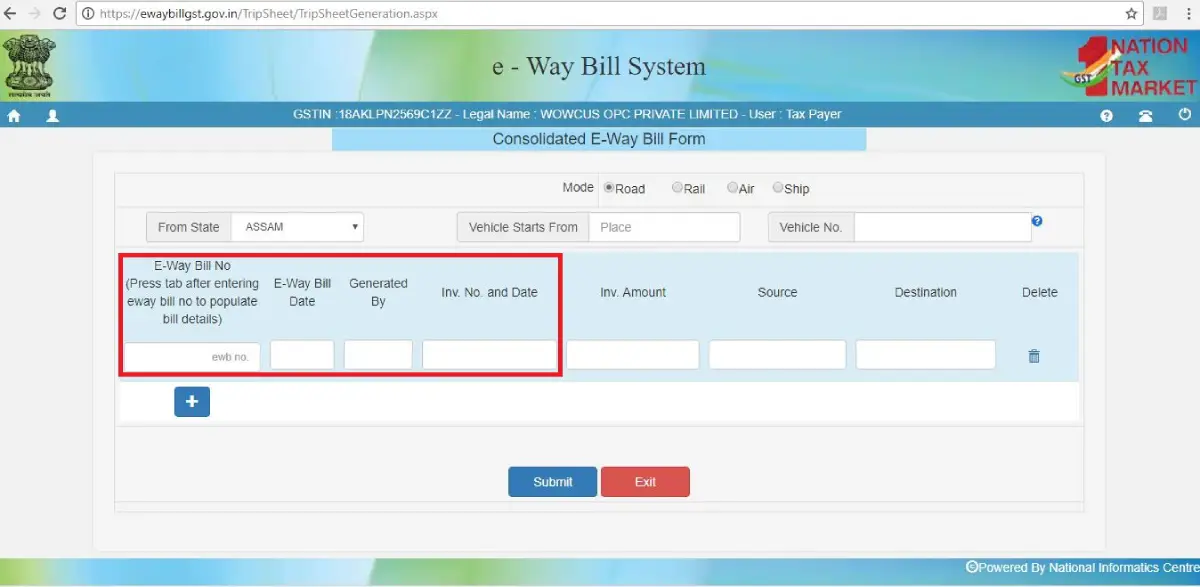

To generate an E-way bill through the official e-way bill portal of the Indian government, you can follow these steps:

- Step 1: Visit the official e-Way bill portal (www.ewaybill.nic.in) of the Indian government.

- Step 2: Login to the portal using your registered credentials.

- Step 3: Click on the "Generate New" button.

- Step 4: Register yourself on the portal by providing your GSTIN number, name, and other details.

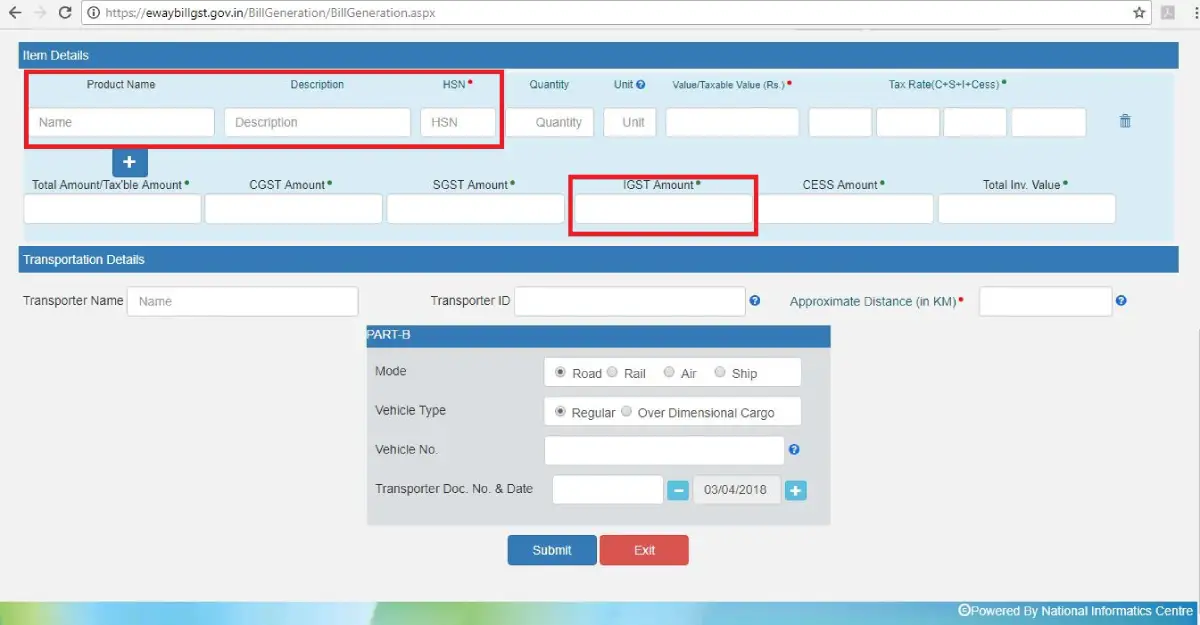

- Step 5: Fill in the required details, such as the type of transaction, the details of the consignor, consignee, and goods being transported.

- Step 6: Enter the vehicle number and other transportation details.

- Step 7: Preview the e-Way bill and make sure all the details are correct.

- Step 8: Finally, click on the "Submit" button to generate the e-Way bill, which will be available in PDF format for download or printing.

It's important to note that you need to have an active internet connection and a web-browser to access the website. Also, make sure to have all the required information and document before generating e-way bill.

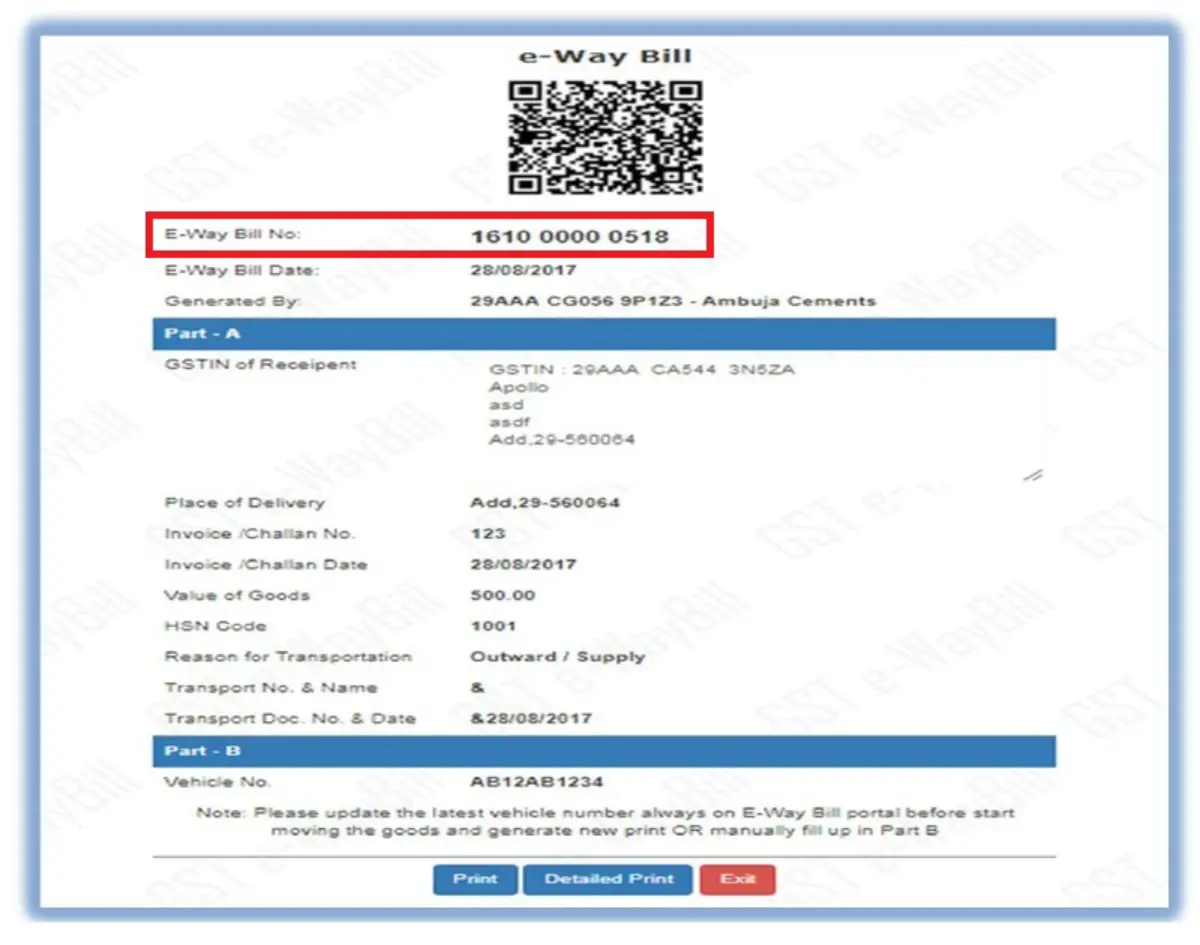

You can print the e-way bill anytime as follows:

You can print an e-Way bill anytime by following these steps:

- Log in to the official e-Way bill portal of the Indian government or the authorized GST Suvidha Provider (GSP) that you have used to generate the e-Way bill.

- Search for the e-Way bill that you need to print. You can search for the e-Way bill using the e-Way bill number, the GSTIN of the consignor or consignee, the date of generation, or the vehicle number.

- Once you have found the e-Way bill, click on the “Print” button to generate a printable copy of the e-Way bill.

- You can either print the e-Way bill immediately or save it as a PDF for later printing.

It is important to note that the e-Way bill must be carried along with the goods being transported and must be produced on demand by the authorities.

This portion of the site is for informational purposes only. The content is not legal advice. The statements and opinions are the expression of author, not corpseed, and have not been evaluated by corpseed for accuracy, completeness, or changes in the law.