GST Certificate Modification is an online process that lets registered taxpayers update their business information on the GST portal. The Government requires every GST-registered business to keep correct and verified details for compliance, communication, and legal reasons. Whether you need to change your address, trade name, business structure, or authorized signatory, the portal provides an easy way to submit the GST certificate modification form along with the necessary documents. Many people also want to know how to download the GST certificate or verify the updated certificate easily.

This guide includes everything about types of modifications, eligibility, required documents, the step-by-step process, fees, and timelines to make the process simple and clear.

What is GST Modification?

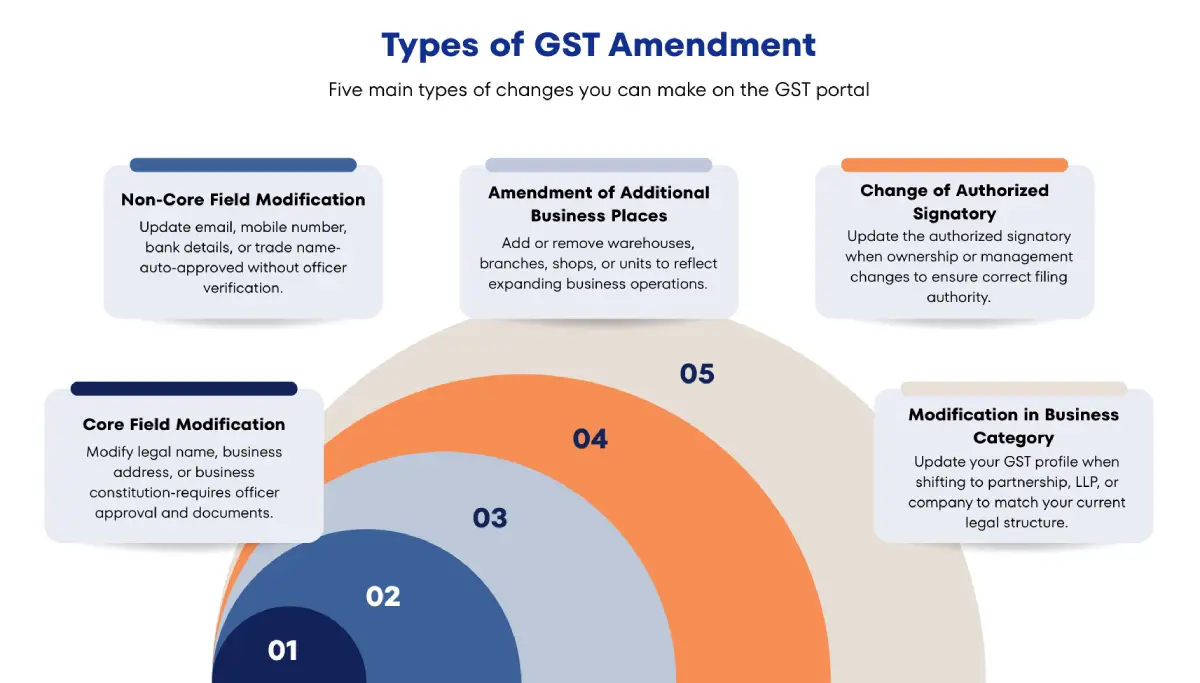

GST Certificate Modification is the process that enables registered taxpayers to update or correct their business information on the GST portal. Businesses often need to make changes like a new address, updated trade name, changes in ownership, the addition of branches, or updates to authorized signatories. Keeping these details accurate helps meet GST laws and prevents issues during audits or tax filings.

To initiate this process, taxpayers submit a request using the GST certificate modification form along with the required documents. Once the GST authorities approve the request, the updated details appear on the certificate. This certificate can be downloaded for GST registration or verified through GST certificate verification. This ensures business records remain legal, accurate, and easy to manage.

Why is GST Certificate Modification Required?

Getting GST certificate modification makes sure your GST profile stay authentic, compliant, and ready for verification. It also reduces the chances of rejection, fines, and mismatch of business information.

- Ensuring Compliance Accuracy: It is important for businesses to keep their details updated for GST compliance. Having an updated certificate demonstrates appropriate information, therefore avoiding unnecessary notices or verification issues and ensures the business remains effortlessly compliant with GST laws.

- Smooth Communication with Authorities: Correct details such as address, email, and mobile number help the GST department communicate effectively. Updated information ensures you receive all important alerts, deadlines, and notices without delay.

- Avoiding Legal or Operational Barriers: Incorrect information may affect business operations, banking procedures, or license renewals. GST modification ensures every document aligns with your legal identity, preventing administrative issues.

- Updating Business Growth Changes: Businesses evolve with time expanding locations, branches, or ownership. Modifying the certificate ensures that these updates are officially recognized and legally valid for future requirements.

- Enabling Correct Claim and Filing Process: Wrong entity type or address can create issues in GST returns or ITC claims. Modification ensures legal correctness, making filings smooth and error-free.

- Supporting Vendor and Client Verification: Clients and suppliers rely on GST certificate verification before onboarding. An updated certificate increases business trust and improves partnerships, especially when expansion or restructuring occurs.

-Limited.webp)

-Private-Limited.webp)

-Private-Limited.webp)

Pvt.Ltd.webp)

-Private-Limited.webp)