DIR-3 KYC is a yearly requirement set by the Ministry of Corporate Affairs (MCA) for anyone holding an approved Director Identification Number (DIN). Its main aim is to keep a director’s personal and contact details accurate and up to date in official records.

This process ensures that every director is traceable and their identity is verified. The process includes verifying a director’s identity, submitting correct documents, and adhering to MCA deadlines. Accurate and timely filing is crucial, as delays can create legal or administrative complications.

What is DIR-3 KYC Compliance?

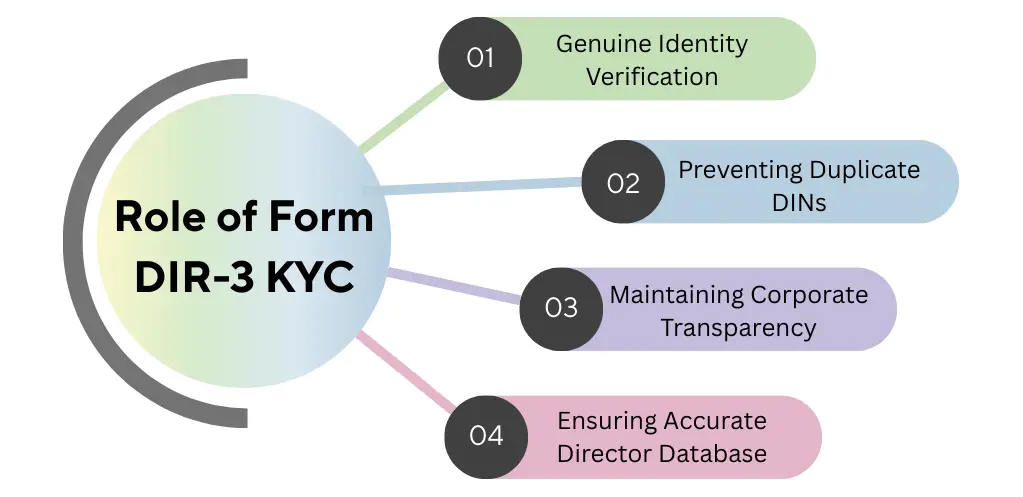

DIR-3 KYC compliance is an annual identity verification process required for all individuals who hold a Director Identification Number (DIN) in India. The Ministry of Corporate Affairs introduced this requirement to ensure that only authentic and traceable individuals act as directors in companies operating under the Companies Act, 2013.

Every DIN holder must file Form DIR-3 KYC if their DIN status is “Approved”. This requirement applies even if the person is not currently serving as a director in any company. The purpose is simple: keep the government records updated and eliminate cases where inactive, fraudulent, or untraceable individuals misuse directorship credentials.

The form collects essential information such as the director’s name, phone number, PAN, Aadhar, email ID, nationality, and current address. The details must match official documents and be verified through OTPs sent to the registered email and mobile number.

DIR-3 KYC must be filed every year on or before 30th September. If the form is not submitted by the deadline, the director’s DIN is marked as “Deactivated due to Non-Filing of DIR-3 KYC, and a penalty becomes applicable. Therefore, to ensure smooth compliance and guard the director’s records, obtaining timely compliance is necessary.

-Limited.webp)

-Private-Limited.webp)

-Private-Limited.webp)

Pvt.Ltd.webp)

-Private-Limited.webp)