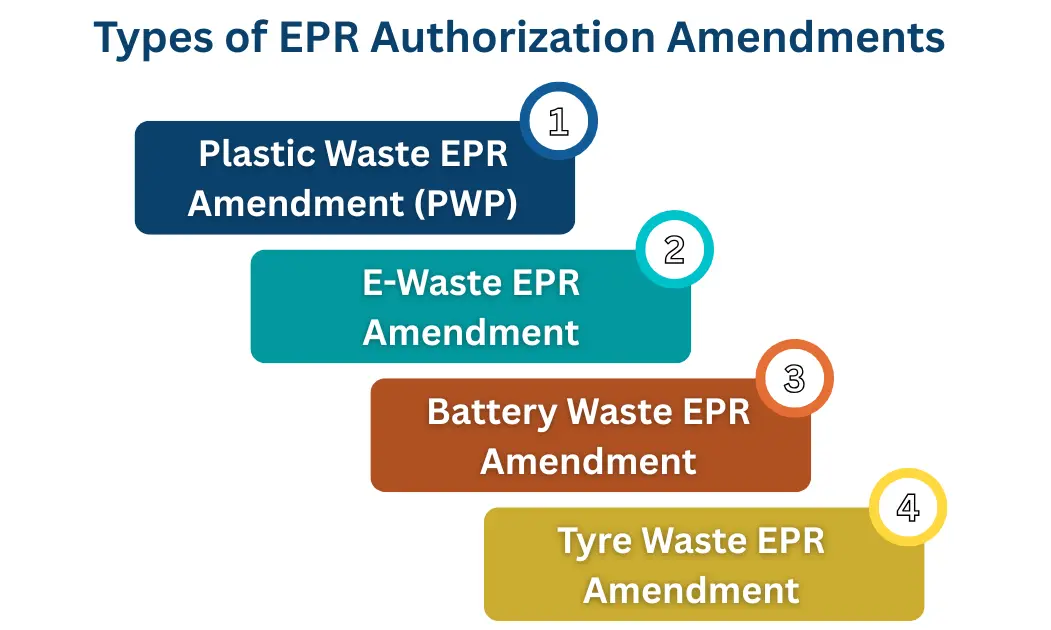

EPR Authorization Amendment is the formal process of updating details already approved under an existing Extended Producer Responsibility authorisation (EPR). It becomes necessary when a producer, importer, brand owner, recycler, or processor makes changes after receiving EPR approval under plastic, e-waste, battery, or tyre waste rules. Since EPR compliance continues throughout the authorization period, any change in products, quantities, brands, recyclers, or company details must be reflected on the CPCB or SPCB portal.

This amendment does not replace the original authorisation or extend its validity. It only modifies specific approved sections while keeping the original timelines and obligations intact. From a regulatory viewpoint, operating beyond the approved scope without updating records is considered as non-compliance, although the recycling processes or target achievement might be met in actual practice.

With regulators increasingly cross-verifying data across CPCB systems and GST records, it is crucial to have similar and updated information. EPR Authorization Amendment helps businesses stay aligned with real operations and avoid unintended compliance risks.

When is EPR Registration Amendment Required?

Whenever an approved EPR does not reflect real operations, the EPR amendments become necessary. These transformations can appear to be administrative ones, yet regulators treat them as material. It is important to know when to apply to help avoid penalties, blocked filing, and denial of EPR returns.

- Change in Product or Waste Category: In case new products, packaging types, or waste categories are introduced which were not part of the initial approval, an amendment is required. Carrying on operations without updating categories is considered operating beyond authorisation.

- Increase or Reduction in EPR Target Quantity: The change in the business growth, decrease in production or change in import volumes directly affects the EPR targets. Any change to the approved quantity should be legally revised to make sure accurate annual target calculation and portal reporting.

- Addition or Change of Recycler / Processor: Changing recyclers, adding new authorised facilities, or removing inactive partners needs portal updates. CPCB checks the linkages of the recyclers when they are audited, and so the amendments are necessary to accept the recycling certificates.

- Change in Company Details or Constitution: Updates such as the name of the company changed, the address changed, a merger, a conversion, and a restructuring of ownership should be reflected through an amendment to ensure continuity of legal sanction of authorisation.

- Correction of Approved Data Errors: There are cases where approvals have typographical or classification errors. Even small errors in the GST, PAN, brand name, or description of the products must be corrected to prevent any future mismatch of compliance.

-Limited.webp)

-Private-Limited.webp)

-Private-Limited.webp)

Pvt.Ltd.webp)

-Private-Limited.webp)